Navigating Today’s Supply Chain Challenges

Global supply chains have faced significant challenges in recent years, forcing companies to reassess their operational strategies.

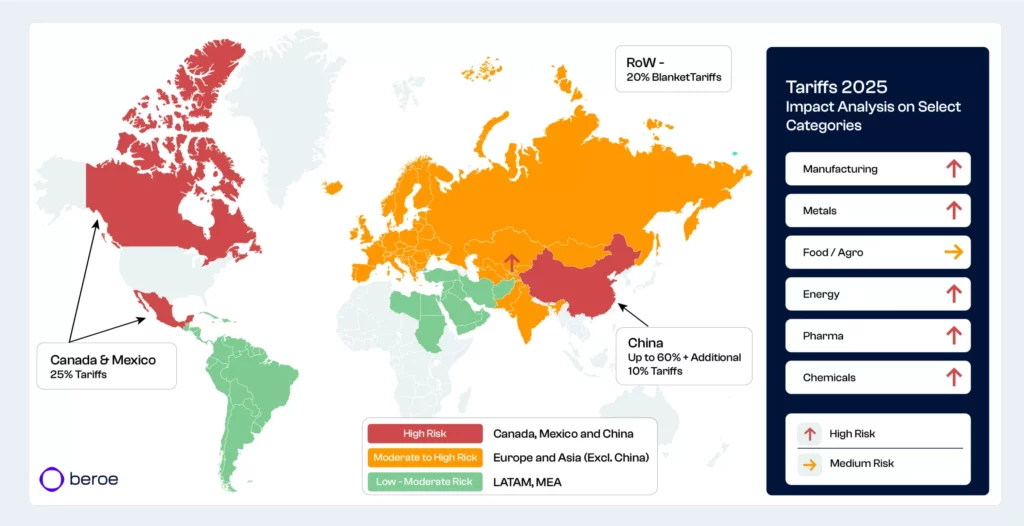

The COVID-19 pandemic exposed vulnerabilities, while US-China trade tensions, geopolitical conflicts, talent shortages, and logistical issues—such as the Red Sea disruption—compounded the difficulties. Additionally, the incoming U.S. President-elect has indicated the possibility of imposing a 25% tariff on imports from Mexico and Canada, as well as an extra 10% tariff on goods from China. These disruptions highlight the growing complexity of managing global supply chains and the need for companies to adapt.

These disruptions have escalated from industrial concerns to threats to economic stability, driving up prices and emphasising the need for organizations to build more resilient, flexible supply chains.

In short, organizations are grappling with some zen questions: Can we develop supply chain solutions to address geopolitical agendas? Can we secure critical minerals or technology for clean energy without alienating China? Are Mexico or Vietnam for example straightforward displacement of China?

Of course, there won’t be a one-size-fits-all solution to counter these threats. To address these challenges, companies must focus on two major imperatives:

- Diversification: Reducing dependency on a single source or region

- Resilience: Building flexible and robust supply chains that can withstand disruptions

The following strategies are becoming critical for mitigating risks, reducing dependency on a single geography, and adapting to evolving global dynamics. Procurement organizations must conduct simulations across various factors—such as supply assurance, lead time, cost, and sustainability—to identify the optimal balance of cost and efficiency.

- Reshoring: Bringing operations back to the country where the company is headquartered. To encourage this shift, countries like the U.S., India, and those in the EU are offering incentives such as subsidies, tax breaks, and loan guarantees. This strategy is particularly relevant for industries such as automotive, renewable energy, aerospace, and semiconductors.

For instance, Nobi, a tech company headquartered in the Netherlands, reshored its assembly operations from China to Belgium, where assembly costs were 18% lower, and labor accounted for just 10% of the total cost. Similarly, Intel is investing $32 billion in new chip plants in Arizona, supported by $7.86 billion in direct funding from the U.S. government.

- Nearshoring: Shifting operations to neighbouring countries within the same region, such as Mexico and Canada for the Americas, or Central and Eastern Europe for Europe. Emerging options in Latin America, like Brazil, Uruguay, and Chile, are also gaining traction. This approach is ideal for industries like automotive, apparel, consumer electronics, and services (IT, BPO).

Examples of Nearshoring Initiatives:

- Tesla is building a new manufacturing plant in Mexico.

- Volkswagen and Umicore have established a joint venture, IONWAY, to produce cathode active material (CAM) for EV batteries in Poland, aiming to reduce reliance on Asian suppliers.

- Foxconn is constructing the world’s largest facility in Mexico to manufacture Nvidia’s GB200 superchips.

- Friendshoring: This relatively new concept involves relocating operations to countries like India, Malaysia, Indonesia, and Vietnam, which offer economic stability and align with favorable geopolitical dynamics. Industries well-suited to this strategy include ICT, Oil & Gas, Chemicals, Technology, and Semiconductors.

Examples of Friendshoring Initiatives:

- Taiwan Semiconductor Manufacturing Co. (TSMC) is investing $35 billion in a U.S.-based chip fabrication facility.

- BYD and LG Energy are establishing EV-related facilities in Hungary and Poland.

- China Plus One: Diversifying operations by relocating certain functions to other Asian countries like Vietnam, Malaysia, Thailand, and Indonesia. This strategy takes advantage of competitive costs, free trade agreements, and sector-specific benefits. It is ideal for industries such as electronics and appliances, apparel, consumer goods, and ICT.

Examples of China Plus one Initiatives:

- Apple is expanding operations in Vietnam and India, with plans to shift 25% of iPhone production to these regions in the coming years.

- Nike and Adidas are relocating parts of their production from China to Vietnam.

Chinese manufacturing costs are expected to grow at a CAGR of 3-4% vs 2.5-3% in Mexico in the next 2-3 years.

Labor cost in China could be approximately $7-$8 per hour compared to $4.5 – $5 in Mexico in the next few years. Labor cost in Vietnam, India is expected to be $1-2 lower than Mexico.

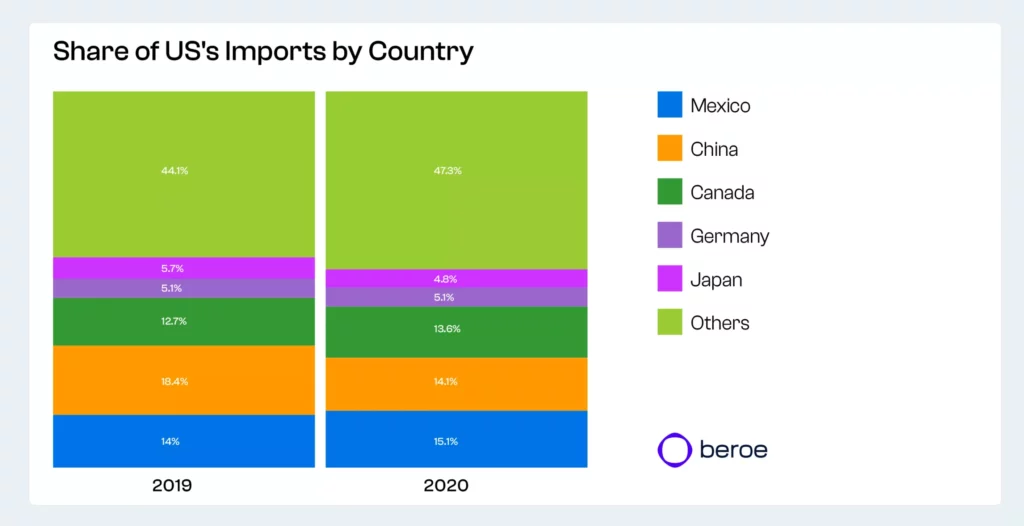

Impact of Recent Protectionist Policies in the US

- Value Chain View: Vietnam and Mexico are receiving more Chinese imports and investment in intermediate goods. This has often resulted in rerouting of Chinese manufactured components to Mexico, Vietnam, and other destinations such as India, where it is assembled and reexported.

- Mexico has become a key alternative to China for nearshoring, benefiting from its proximity to the US, free trade agreements (notably US-Mexico-Canada Agreement (USMCA)), and competitive costs.

- In 2023, Mexico surpassed China as the US’s largest trading partner with highest share in US imports

- Automotive, Electronics & Tech and Manufacturing sectors lead in US-Mexico nearshoring trade, with robust investment and new site announcements from US firms.

- This growth underscores Mexico’s expanding role as a key trade partner for the U.S., likely fueled by economic incentives.

Tariff Policies and Tariff Proposals

President-elect Donald Trump plans to significantly increase tariffs on imports from several countries, particularly China, Mexico, and Canada. These measures aim to reshape US trade policy by focusing on imports that are perceived to be threats to national security. Also, as a protectionist agenda these tariffs and trade proposals are intended to encourage companies to reshore manufacturing to the US.

Chinese Influence in Mexico:

- Chinese investment in Mexican manufacturing is growing as companies use USMCA rules to bypass U.S. tariffs on Goods Originating from China.

- By importing components from China and assembling them in Mexico, these products qualify as “Made in Mexico,” allowing them to enter the US market tariff-free.

- Increased U.S. scrutiny to limit Chinese investments in sensitive sectors, aligning with broader trade restrictions on China.

General Impact:

- The upcoming 2026 renegotiation of the USMCA may tighten the regulations on Chinese investment in Mexico and introduce provisions supporting US production.

- Additional U.S. trade measures could restrict Chinese goods in the USMCA region, potentially reducing Mexico’s nearshoring appeal

The proposed tariffs are designed to incentivize companies to reshore manufacturing to the US by making foreign production more costly.

Factors Influencing Supply Chain Decisions

The following table highlights the risk factors and their relative impact across the four supply chain strategies.

Roadmap for companies

The following is a framework that enables companies to develop a successful supply chain strategy

Step 1: Identify what the main goal is with the supply chain strategy. Example of decision criteria includes:

| Business Goal | Preferred Strategy | Reason |

|---|---|---|

| Reduce dependency on China | China Plus One | Balances cost and risk by diversifying suppliers. |

| Shorten delivery timelines | Nearshoring | Proximity reduces logistics delays. |

| Build a resilient supply chain | Friendshoring | Trusted allies ensure reliability and compliance. |

| Innovate and improve product quality | Reshoring | Access to advanced infrastructure and skilled labor. |

| Cost Reduction | China Plus One or Nearshoring | Balances labor and setup costs with moderate proximity and diversification. |

| Customer-Centric Businesses | Nearshoring | Proximity to key markets reduces logistics costs and delivery times. |

| Risk-Averse Businesses | Friendshoring or China Plus One | Mitigates reliance on single regions and geopolitical risks. |

Step 3: Analyze industry specific needs as sectors with high compliance requirements such as Pharma, Energy etc. lean towards reshoring, nearshoring or friendshoring, while labor-intensive industries such as BPO, Apparel or Electronics might benefit from China Plus One or nearshoring

Step 4: Use Scenario planning and predictive analytics to proactively anticipate global/microeconomic events such as trade sanctions, pandemics, or climate events. Running simulations and predictive analytics are critical for understanding various “what-if” scenarios and evaluating the impact on cost, lead times, and risks.

Step 5: Consider factors beyond cost such as scalability, regulatory landscape, customer preferences, workforce dynamics, sustainability goals etc. when selecting regions for operations

Conclusion

Modifying a global supply chain is a complex and time-intensive process. Companies need to reassess their manufacturing and investment strategies, considering the costs of relocating production versus potential tariff impacts. Preparing in advance for changes in international trade laws, including tariffs, can offer a competitive advantage.

Successful companies focus on agility, ensuring their supply chains aren’t dependent on one strategy or geography. Each approach has its benefits and challenges. To succeed, businesses must adopt a mix of strategies, using scenario planning, spend analysis, and risk management to adapt to changing trade policies and market conditions.

Learn more on how Beroe can help you optimize your supply chain

Related Reading